Balancing the Books: AI’s Double-Entry into European Accounting Excellence

Here is why the next generation of fintech software using AI will transform the business accounting services for good.

Commonly regarded as the language of business, accounting serves as the cornerstone for financial decision-making, regulatory compliance and strategic planning within organisations, large and small. Rooted in meticulous record keeping, precise calculations and adherence to complex standards, accounting has historically relied on human expertise and attention to detail. However, the large-scale introduction of LLMs and Generative AI is leading to a new era, offering transformative value creation possibilities through automation and optimisation of accounting processes.

Accounting is particularly amenable to AI automation due to its rules-based nature and reliance on unstructured inputs dispersed across data sources (paper receipts, anyone?). Unlike many other fields where some level of subjectivity can prevail, accounting operates within a framework of rules, principles, and established procedures. The results of accounting processes can be classified into two categories: those that are unique and factually true (e.g. displaying the correct amount of cash at a given point in time in the CF statement), and those that are prone to human judgment about future business expectations (e.g. the valuation of financial or intangible assets on the balance sheet).

AI can assist in automating efficiencies for both of these workflows. Accounting is characterised by the generation and processing of vast volumes of data, which presents an ideal opportunity for AI to extract, categorise and reconcile it, detect patterns, show real-time insights and forecast future trends with speed and accuracy.

Why accounting is still so complicated

Complying with local regulations

The business accounting landscape varies significantly across countries due to differences shaped by local regulations, market dynamics, and cultural influences, which makes the situation particularly demanding for multi-entity companies. However, common challenges that transcend borders and legal frameworks include compliance with constantly evolving standards, maintaining accurate financial records, and preparing reliable financial statements for decision-making. This is occurring whilst simultaneously facing a shortage of talent in the accounting profession in many countries, as demand for expertise grows and demographics shift.

Local complexities in accounting result from the existence of various legal and regulatory frameworks. The United States adheres to the Generally Accepted Accounting Principles (GAAP), while under EU rules, listed companies are required to adhere to both national standards and prepare their consolidated financial statements in accordance with International Financial Reporting Standards (IFRS). Additionally, various other requirements apply to non-listed and small businesses. Germany is often cited for its complicated accounting laws, with the German Commercial Code (HGB) providing a comprehensive framework with detailed regulations that can be complex to navigate. Furthermore, accounting standards can be highly dynamic in response to changing economic demands and internationalisation.

Relying on PDFs and legacy systems

In Europe, SMEs struggle with labour-intensive manual data extraction, categorisation and entry processes, repetitive tasks such as reconciliations and ledger entries, not to mention the inherent risk of human error associated with manual financial data handling. We still live in a world where an SME collects pdf/paper invoices and sends them to their accountant or tax advisor at the end of each month. Additional complexity in many European countries comes from legacy core accounting systems still running on-premise. In Anglo-Saxon markets, Xero and Quickbooks have done a good job of building cloud-native systems for small businesses, where businesses and accountants can collaborate on the same platform and exchange data in real time. In countries like Germany, core accounting runs on legacy systems like DATEV, where a business has no access to its general ledger and receives static reports of its finances every month. This lack of innovation around core accounting, which only allows for a one-way export of data to the general ledger, has been a challenge for pre-accounting and financial management start-ups in Germany.

Labour shortage hitting accounting firms hard

In recent years, the accounting sector has become increasingly concerned about labour shortages. In the US, for example, the number of people taking the CPA exam has been falling every year since 2016, coupled with declining interest in university accounting courses, meaning this trend isn’t going to reverse any time soon. We are seeing the boomer generation reaching retirement age and leaving the workforce, with no replacement of talent from younger generations. Across the pond in the UK, the challenges facing the industry may be less extreme, but there are lessons to be learned from the US situation. Technology-led innovation that helps shift some of the manual, service-heavy work away from individuals to human-in-the-loop software products will be critical to achieving compliance and audit trails more efficiently, and to sustaining the accounting profession’s talent base.

Transitioning into the age of AI-native accounting

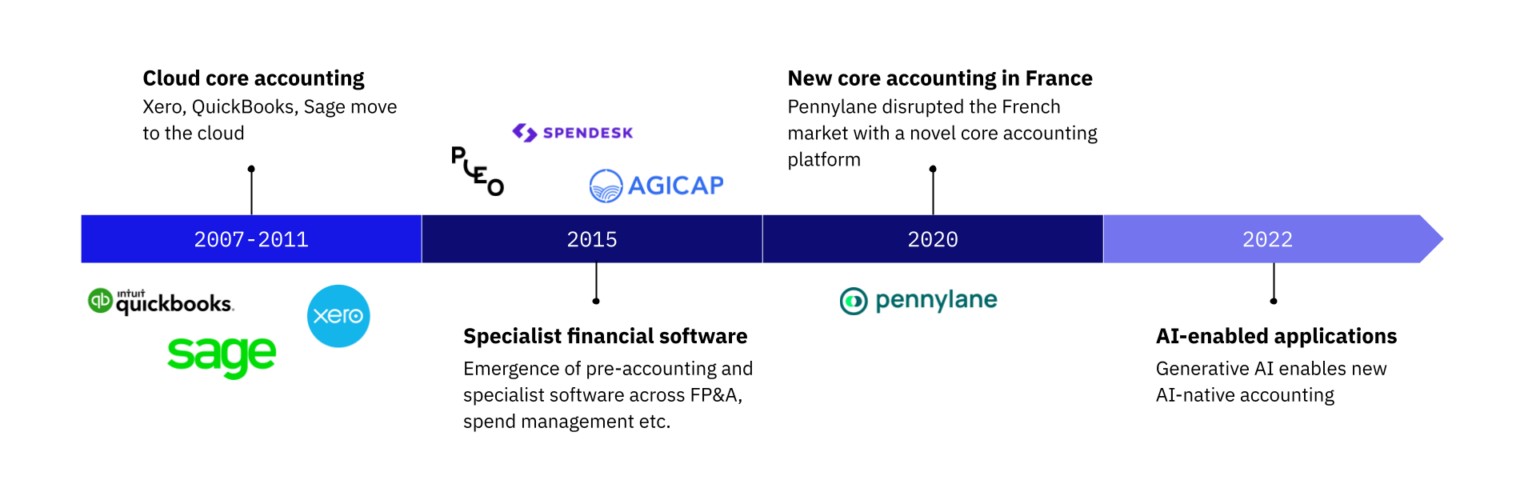

We have seen 3 main waves of innovation in the European accounting software stack:

- Core accounting moving from on-premise into the cloud: In English-speaking countries, Xero pioneered cloud accounting in 2007 with Quickbooks fully embracing it by releasing QuickBooks Online in 2009. In 2011, Sage also caught up and launched Sage Business Cloud Accounting.

- Pre-accounting & financial management software creating a CFO stack: From the 2015s, almost every part of the business has seen innovation, from spend management (e.g. Pleo), via business banking (e.g. Tide, Qonto) to FP&A (e.g. Agicap), etc. where specialist software owns a certain part of the financial data, which later gets consolidated in the ledger.

- New core accounting software disrupting local markets: While Xero and Quickbooks have been serving small businesses well in the UK, businesses in local European markets were still using legacy systems, having no real-time overview of their finances. In 2020, Pennylane (who just became a unicorn) disrupted the French accounting market previously dominated by Cegid and Sage, by offering a unified platform for businesses and accountants and streamlining data sharing with third parties. The rest of continental Europe is still largely stuck in legacy core accounting.

Despite all the innovation in this area, SME accounting is still time-consuming and tedious work, while accountancy firms struggle to attract new clients in the face of a growing labour shortage.

LLMs hold the key to accounting 4.0

We firmly believe that the rise of LLMs is the missing puzzle to unlock accounting 4.0 and that the next generation of accounting software will be AI-native. Accounting work is largely based on unstructured data inputs (invoice items in natural language, depreciation charges etc.) and here, LLMs can be particularly good at understanding the context specifics.

LLMs can already automate routine manual tasks for businesses and their accountants, such as:

- Digitising and validating invoices from dispersed sources

- Categorising expenses

- Selecting applicable VAT

- Reconciling with transactional data

The biggest impact in the near future will be the automation of user workflows, eliminating manual work on the pre-accounting side.

From a product perspective, we generally see two main approaches today, combining an AI co-pilot with a human-in-the-loop. Keeping the human in the process is important – the state of AI today is far from trusting autonomous accounting agents.

- Automating pre-accounting work: Financial planning companies for SMEs, like Trezy, enable CFOs to see financial positions in real-time by connecting all transactional data, invoices and automatically categorising these. Others, such as Embat, have approached the space from a treasury management angle, also aiming to become the data consolidation layer that later feeds into core accounting systems.

- Automating accounting work and tax filing: Companies such as Transluscent and Mayday help multi-entity teams consolidate financial data across multiple accounting systems and entities. In the US, for example, companies like Blackore help accountants with tax preparations, while Puzzle aims to replace Quickbooks and is already moving towards rebuilding the general ledger.

As LLMs evolve in the future, we believe that the biggest opportunity will be in rebuilding the general ledger itself.

No room for error in accounting, but room to build the next game changer

Today, core accounting firms employ large engineering teams to code accounting rules into software logic, which are extensive and change over time. For new players, it takes time, capital and human resources to achieve feature parity with the incumbents. As discussed above, accounting rules are also localised, which means you have to rebuild a significant part of your product if you want to enter new geographies. Models such as GPT4 are good at understanding specific tasks, but are not yet ready to create a general ledger entry on their own and are not trained in local European accounting rules.

Finally, there is no margin for error in accounting, so it will be some time before we see AI-native general ledgers. When we do, it will be a game changer: accounting software will suddenly break the linearity between the amount of capital required and the release of product features, and have a chance to scale faster around the world.

At Project A, we spend our time thinking through where the impact of AI will be most profound and where the generational businesses of tomorrow will be built. We are incredibly excited about the role that next-generation software and AI will play in transforming parts of the large business accounting services market into software spend, while empowering accountants, advisors and auditors with easy-to-use tools and allowing professionals to increasingly focus on strategic, high-value areas.

If you are a founder building in the AI-native accounting space, we would love to meet you.